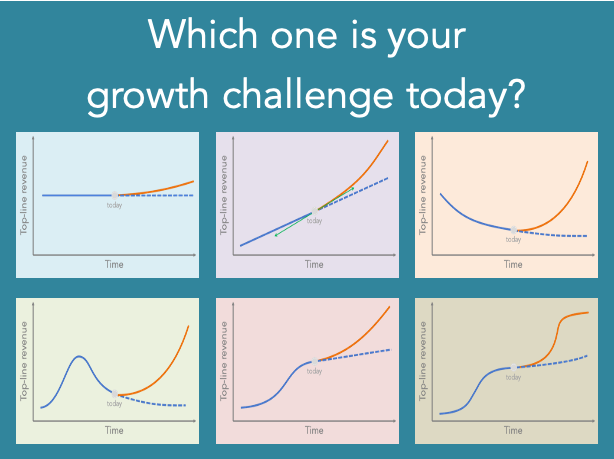

The six models of growth

In the business world where markets are rapidly changing, top-line growth is critical for survival. As Bracken Darrell, the CEO of Logitech, once told me: “There is only growth and death.” In my book, Aligning the Dots, I call this the Growth Imperative.

New contenders are relentlessly entering the race with disruptive ideas and technologies, accelerated innovation shakes the status quo, and new business models are invented. Savvier consumers demand more value from the goods and services they consume and want to enjoy new, always more exciting, simple, intuitive user experiences. In this environment, a company that is not adapting fast enough with the obsession to grow faster than its market will become numb and start a slow decline to irrelevancy. Simply said, growth is a practical matter of life and death.

Since we started Blue Dots Partners six years ago, we have been helping companies grow faster. What’s very interesting is that size does not really matter, in companies from $10 million to over $1 billion in revenue we have noticed similar patterns in the growth challenge they are facing. In fact, we identified six.

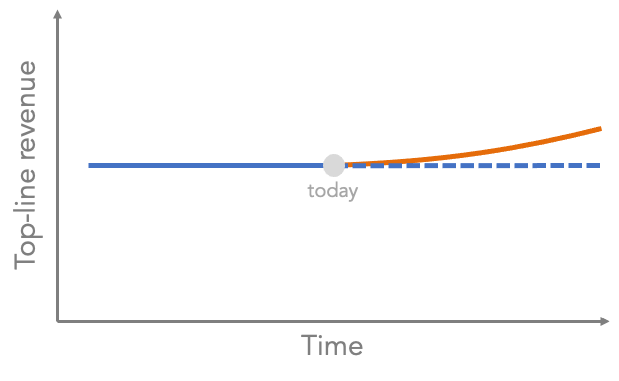

Case 1: Growing at last!

This situation happens when a company has not experienced any real growth for some time. A change might trigger new sources of growth from the appointment of a new CEO, a change of ownership, a new board of directors, an infusion of capital or an electroshock urging the company to attack new markets or launch a new offering.

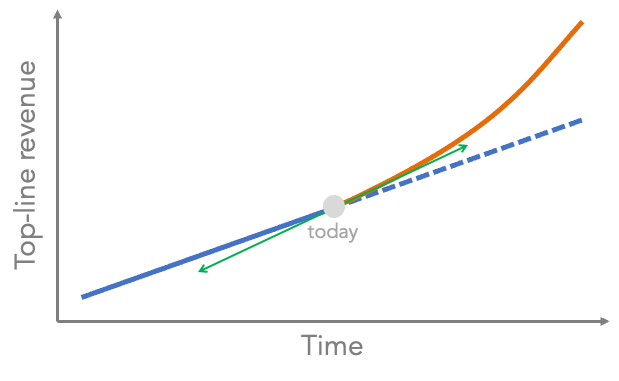

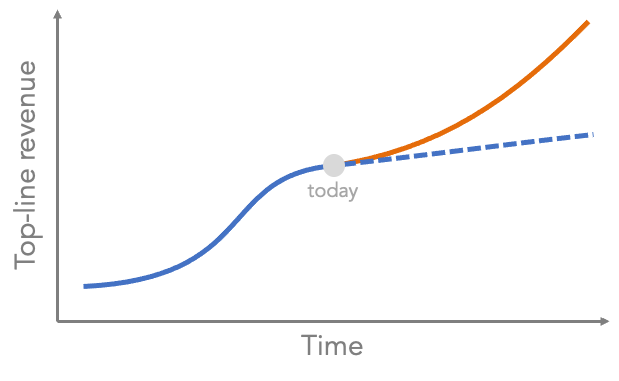

Case 2: Accelerating growth

Note that the green arrows represent the growth rate of the market today. In this case, because the slope of the blue curve is less than the slope of the green line, the company is losing market share. This also applies in a declining market where the slope is negative.

This is a case when a company has been growing but must grow faster because they have been losing market share (like in the figure above) or because they must capture a larger percentage of the market to continue to fuel and finance their vision/ambition.

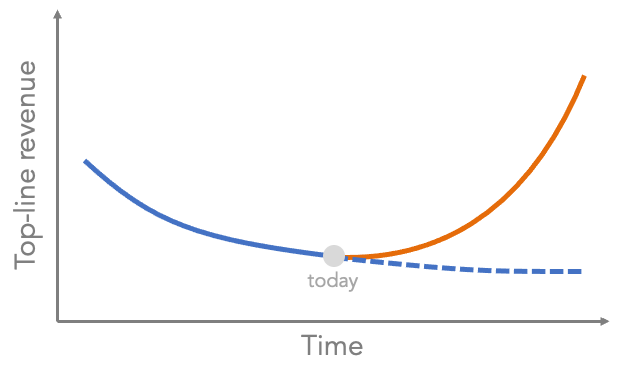

Case 3: Reversing the growth trend

This is the case, where the company has seen declining revenue or a negative growth rate and wants to start the growth engine and generate increased revenue.

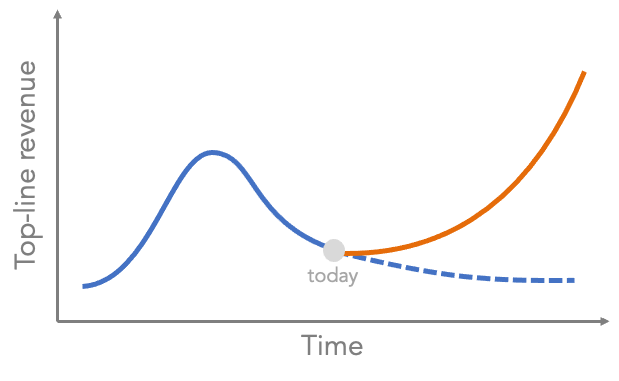

Case 4: Restarting the growth engine

This is when the company has enjoyed a high growth rate during an initial period of time and then, growth stalled, and revenue started to decline (negative growth rate). The challenge here is to restart the growth engine that has stalled to start growing again or to find a new growth engine.

Case 5: Reclaiming momentum

This is the case when growth has decreased, even though revenue has kept growing albeit not as much as it used to. If no action is taken, then revenue might grow anemically and, in most cases, competitors are going to steal market share from the company.

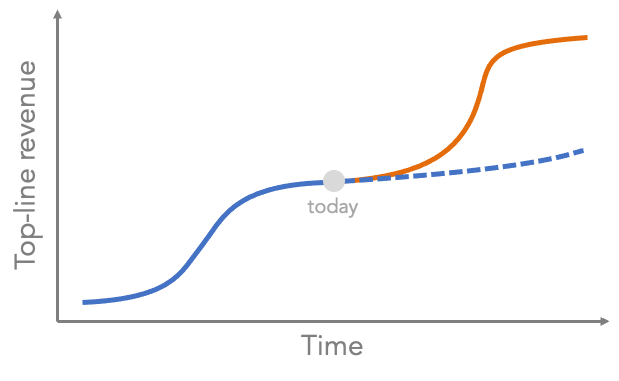

Case 6: Finding the next S-Curve

This typically happens in new markets when a few companies are experiencing tremendous initial growth and after a while, as the market gains maturity, growth is not there anymore. The business now is facing the challenge of finding the next S-curve. This is typically done by going after new markets or launching new products. A good example of that is Apple launching the iPhone in 2007 to restart the declining growth that the Macintosh market has experienced.

Conclusion

Although it’s important to understand the past trends, what really matters in what’s happening today, right now, in your marketplace. What is your growth rate today compared to the market growth rate? What is the derivative of your top line compared to the derivative of your market total revenue? If you are not growing faster than your competition, you are losing market share and are clearly not delivering sustainable shareholder value. Conversely, if you grow faster than the market, then you are creating significant shareholder value. The best illustration of this is the stratospheric market value of super fast-growing companies as compared to their industry, their market value can get to 8-10X their current revenue even with negative profitability!!! Why? because the market recognizes that they are the future market winners, they will dominate their market, and become super profitable while all the others will be the losers.

What really matters is that at a given point in time (today), you want your growth rate to be higher that the market growth rate (either could be positive or negative). In a way, what happened before (existence of an S-curve for example) is somewhat irrelevant.

If you are growing faster than your market, don’t become complacent and continue to challenge yourself to keep the momentum and even accelerate, and you will unleash significant shareholder value. If you are growing less than your market, you must call for a state of emergency and understand what must be changed before it’s too late.

Whether you are a $10 million or $10 billion company, the questions to ask are: What is your growth challenge today? Which case applies to your company?

Answering these questions must become a habit, because again, growth is a practical matter of life and death, and the time is now.