To borrow or not to borrow. That is the question.

We all hope for a rapid economic recovery, but most of us want to be prepared for an endurance race. In April, nearly 300 business leaders responding to the Blue Dots survey regarding the economy made suggestions on how to mitigate economic uncertainty and ensure there is sufficient fuel in the tank for the long haul.

One of the common themes was tight management of cash and debt. The Federal Reserve’s recent confirmation of an extended period of low interest rates makes it tempting to take advantage of “near-free” money to fund operations, finance capital purchases, or create a cash cushion. It does not hurt to think about Ogden Nash’s comment that “Some debts are fun when you are acquiring them, but none are fun when you set about retiring them.”

With that thought in mind, we recently talked with several CEOs regarding their attitude toward debt. Each CEO was either in the process of developing a financial strategy that evaluated the role of debt, or had already done so. The forces and factors entering into their strategies varied by industry, company stage, and the company’s projected financial status. Three macro factors and one more micro consideration caught our attention:

- Ongoing, intense economic uncertainty.

- Troubling corporate debt trends.

- An accelerating shift from globalization to localization.

- Market and financial conditions specific to each company.

Following is a little more detail, including potential debt-related implications or actions for your business.

1. Economic Uncertainty: Doubts remain about the likelihood of a V-shaped economic recovery. After a 5 percent contraction in the first quarter of 2020, second quarter 2020 U.S. GDP decreased 32.9 percent (annualized rate compared to the first quarter of 2020) in the single largest quarterly contraction in 75 years. Although The Conference Board predicts the current quarter will result in a 26% rebound, they foresee a 1.6% contraction in the fourth quarter and do not expect a full recovery until early 2022. [i]

As of August 22nd, 27 million people in the U.S. were claiming unemployment benefits, more than sixteen times the year ago level. Economic powerhouses California (16%) and New York (15%) posted the third and fourth worst unemployment percentages. [ii]

While some sectors of the economy have barely suffered or have even benefited from the pandemic, many sectors will require an extended recovery period or may never fully recover. Examples of challenged sectors include Leisure and Entertainment, Retail, and Energy.

→ One implication for your business is to lower the risk created even by low-interest debt obligations. This is particularly true if your company or customers are engaged in the markets that are suffering. An objective, clinical assessment of unproductive assets and other assets that could be liquidated without damaging the core business could help increase cash and lower debt.

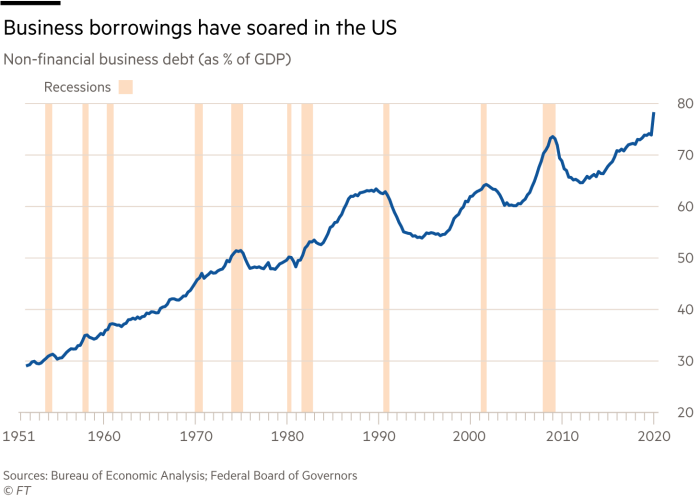

2. Corporate Debt Trends: As of July 2019, total U.S. corporate debt among non-financial companies and including small businesses was $15.5 Trillion, or 74% of U.S. GDP.[iii] When was the previous peak in corporate debt? You guessed it, 2008.

One third of current corporate debt is in the form of leveraged loans and below investment grade bonds.[iv] Default rates are rising, despite the Fed’s commitment to buy corporate debt and the federal government’s $500 Billion small business loans program. The institutional term loan default rate has increased to 4.3%, the highest level in more than a decade. Some sectors are far above that average, including Retail at 19% and Energy at 16%. Fitch expects the Leisure and Entertainment sector to hit a 40% default rate by the end of next year.[v] All of this indicates that most businesses are not “too big to fail”.

→ In addition to being wary of your own borrowing, it is important to consider the debt burdens of your vendors and customers and keep tight control over vendor selection and receivables.

3. The Shift from Globalization to Localization: Value chains are undergoing major structural changes due to international trade issues and more fundamental underlying trends in data management, manufacturing, logistics and labor cost differences. This ongoing transition is likely to impact virtually all companies engaged in manufacturing and distribution of physical goods. The transformations may disrupt supply chains; require building new vendor and distribution relationships; and mandate new capital investment. A key action “…is to maintain control, trust, and collaboration in all parts of the value chain. For some companies, this might mean bringing more operations in-house. Those that outsource need close supplier relationships and greater visibility into lower tiers of the supply chain.”[vi]

→ Resourcing new operational strategies and value chain relationships may require sizable investments and a more agile approach. Businesses need to preserve sufficient borrowing capacity to supplement cash required to fund change.

4. Conditions and trends specific to your own market and business: Your business is, of course, unique, with its own opportunities and challenges. In addition to weighing the three concerns above, how do you judge how much debt is too much? The last thing you want to do is to have so much debt, your business is borrowing more just to pay the interest, let alone pay down the balance.

If you did not deleverage before the economic collapse and are carrying or contemplating substantial debt, you might consider evaluating how closely your business aligns with a few financial rules of thumb. Of course, you and your company CFO are already familiar with all of the standard ratios: Debt-to-Equity, Debt-to-EBITDA, Cash Interest Coverage, EBITDA minus CapEx Interest Coverage, and the Fixed Charge Coverage Ratio. But it is a good exercise to revisit and track those metrics. In terms of some broad aggregate guidelines, you may also want to consider the following:

- Average debt-to-assets ratio: The ratio was 38.3% among firms that increased debt levels in the run-up to the Great Recession and 19.5% for companies that made an effort to deleverage

- A debt ratio of 0.4 or lower is widely considered to be a target.

- A debt ratio of 0.3 – 0.6 is generally considered to be reasonable. Companies with capital-intensive businesses are often at the higher end.

- A debt ratio of 0.6 or higher makes it more difficult to borrow money…just when you need it.

→ In addition to one-time deleveraging and monitoring debt ratio alignments, try developing a “healthy company” model. In addition to evaluating your business on its own, compare to what you consider to be comparable or near-comparable public companies and develop objective analyses for differences that are identified. Then set the targets, chart the course to close any misalignments, and actively manage to those goals.

Debt is a great resource when managed as a component of a

thoughtful and balanced corporate financial strategically. In volatile times, being

a little more thoughtful cannot hurt.

[i] The Conference Board Economic Forecast for the US Economy, 8/13/20.

[ii] Bureau of Labor Statistics, 8/27/20

[iii] Data and graphic from the Financial Times, 7/9/20 and Bureau of Economic Analysis.

[iv] Forbes: U.S. Corporate Debt Continues to Rise As Do Problem Leveraged Loans, 7/25/19.

[v] Fitch Ratings, U.S. Leveraged Loan Default Insight, 7/25/19

[vi] McKinsey & Company, Globalization in Transition: the future of trade and value chains, 1/16/19.