Why you have to be crazy to start a company…

Startups, in the early-stage of their lives, are very dynamic, nimble and aggressive. It is not uncommon in Silicon Valley to witness a company grow from 12 employees one year to 80 employees the following year and within a few years, see its headcount reach several hundred employees. These corporations rise fast and, in many cases, crash and burn at a mind-blowing speed as well.

These fast-growing businesses represent the dream. The pursuit of being indicted, in the Unicorn Hall of Fame with the likes of Tesla, Facebook or Salesforce. The dream of making a dent in the universe. For a VC, it is the fear of losing out on the opportunity to become an investor or Board member and be associated with one of these well-recognized unicorns. This is what drove 1,328 VC firms to invest $133 billion worldwide in 10,430 companies in 2019 alone [source: NVCA 2020 Yearbook].

However, it is a brutal world out there. The number of companies in the US alone receiving VC money averaged 2,800 per year during the years 2015 – 2017 [source: KPMG Venture Pulse Q4 2017]. According to Fundable, only one in 2,000 startups raise money from VCs. The vast majority of the millions of startups in the US raise funding from personal savings and credits, friends and family, angel investors, banks or crowd funding [source].

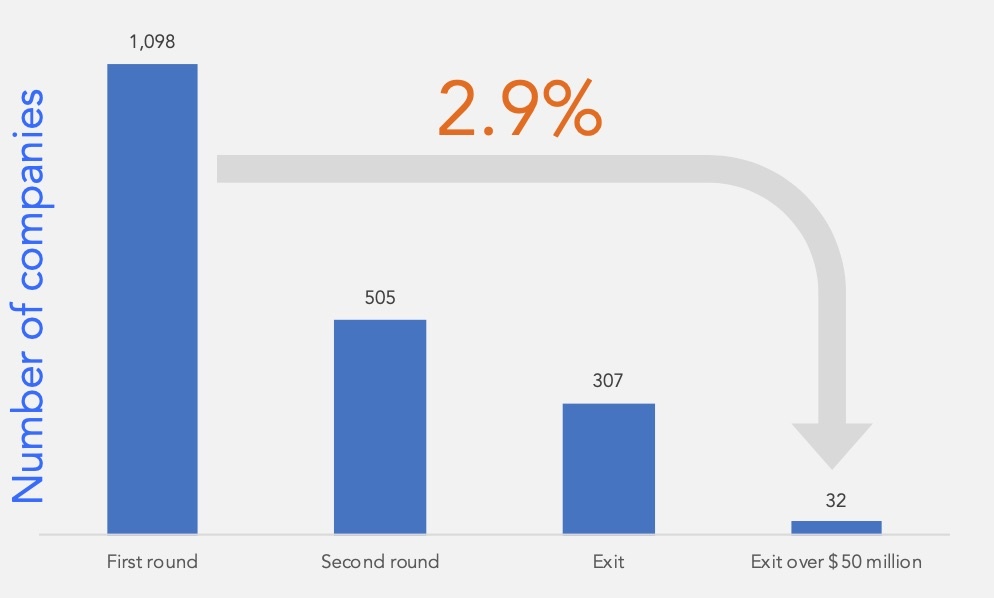

Let’s not be mistaken: even after raising seed financing, the casualty rate is very high. In March 2017, CB Insights analyzed a cohort of 1,098 tech companies headquartered in the US that raised seed financing in 2008, 2009 or 2010. They followed these companies until February 2017 to give them enough time to go through their lifecycles. It turns out that 46% of them raised a second round of financing and 28% exited through an M&A or IPO within 6 rounds of funding. Some of these liquidity events produced great multiples to investors while other were money losing exits. Only 32 of the cohort had an exit with a valuation over $50 million. If we consider these as financially successful exits, it means that a mere 2.9% of the companies enjoyed a financially good exit for the investors. It is important to observe that if that analysis were to be done with a cohort of the past few years, the percentage of successful exits would be a lot smaller. This is because there has been a plethora of seed and micro VC funds deploying seed capital in a much higher number of startups in the past few years. Source.

Figure 1-2: Cohort of US tech companies that raised a seed financing from 2008 to 2010

It has been argued by some entrepreneurs and VCs that returns are subject to a power law. Marc Andreessen from the prominent Andreessen Horowitz VC firm, explained that 15 of the top 200 VC-funded companies generate 95% of all economic returns and that even the top VCs write off half of their deals. Peter Thiel pointed out that we lived under the power law where value is exponentially created by very few companies reaching exponential growth. This is more generally described the Pareto Principle or the 80/20 rule, sometimes also as “the principle of factor sparsity.” It basically states that in many cases, roughly 80% of the effects come from 20% of the causes.

Experienced and more humble Venture Capitalists will tell you that it requires a solid dose of luck to invest in a Unicorn when you focus on seed- and early-stage or the proverbial “two guys and a dog in a garage” companies. Past the mundane and glamorous cocktail party discussions, it is a brutal world that knows no mercy, where failures and disillusions are breaking many dreams and where hopes evaporate in a matter of days. I subscribe to the school of thought that the learning from these falling angels are incredibly worth the journey, but it is certainly not for the faint of heart.