Is Macy’s becoming an extinct species?

A few weeks ago, on November 13, “Mad Money” host Jim Cramer shared his view about Macy’s and JC Penney becoming “relics” of the retail past. Are bricks and mortar becoming irrelevant during a time when Amazon Prime, 1-click purchase, same-day delivery, recommendations, social media shopping, mobile shopping and peer product reviews are embraced by more and more people?

Sales at Macy’s have been declining over the past 3 years. They peaked at $28.1B in FY 2015 (Macy’s FY ends on January 31st). During the same period, Amazon grew revenue 53% from $89.0B to $136.0B (Amazon’s FY ends on December 31).

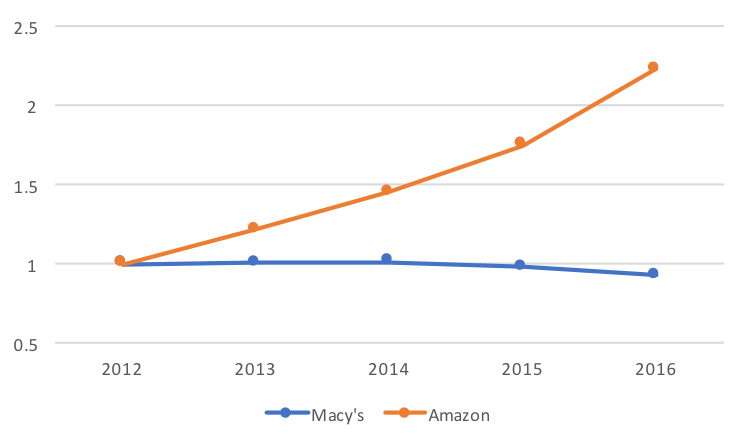

In order to compare top-line growth rates, I normalized revenues in 2012 and plotted the evolution over the past 5 years and here is how it compares:

Normalized revenue (in $B) of Macy’s and Amazon from 2012 to 2016

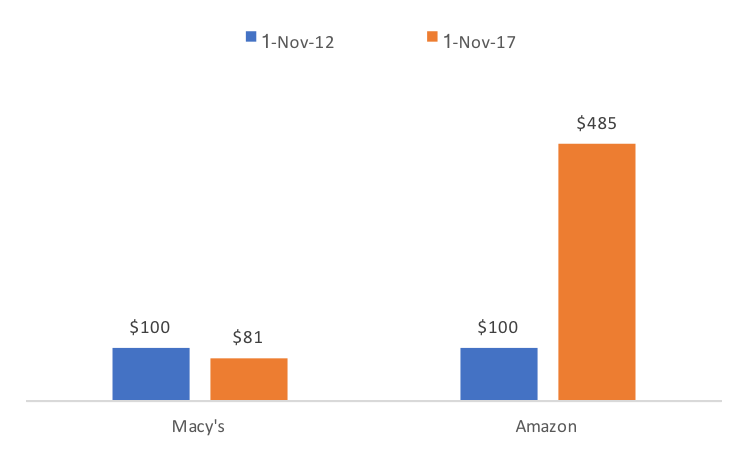

Just looking at the graph, it is not hard to decide which stock to invest in. Let’s do the math and examine how revenue growth correlates with shareholder value creation. If you had bought $100 of Macy’s stock five years ago, on November 1, 2012 and the same $100 of Amazon’s stock, exactly 5 years after, your Macy’s stock would be worth $50.80 and your Amazon position would be worth $484.84. So, while you would have lost about half of your money in Macy’s, you would have made about 5 times your money in Amazon.

Value of an investment of $100 5 years later

Here is Jim Cramer’s view on Macy’s defense argument for its poor performance: “Instead, we heard the same kind of tale of woe, the struggling stories, the same defensive nature, with the only twist being a better control of inventory and a sense that they can continue to plod along.”

It is very hard for Macy’s to offer the same kind of consumer experience as Amazon. For Macy’s there is simply too much “distance” that separates the physical store and the shopper’s attributes. If I walk into a Macy’s store, Macy’s does not know my tastes, what I bought in the past and if I like or disliked a previously purchased products. They don’t know how much time I spend in the store, what aisle I visited, what products I took off the shelf to look at, or my credit card number. They don’t know the zip code I live in, which is a good proxy for how much money I make. Amazon magically knows all that.

In the meantime, Macy’s is closing 68 stores and J.C. Penney is doing the same with 138 stores. And Amazon… is adding servers and is provisioning more and more bandwidth in its data centers around the world.

Now, it is not trivial to grow revenue in a market that is not growing as fast. In fact, the most effective way is to grab market share from a competitor. It is unclear who these competitors would be in the case of Macy’s. To be fair, US retail eCommerce has been growing at a CAGR of double-digit 11.9% per year between 2012 and 2016 grabbing only 7.2% of the US retail market in 2015. So, it is easy to extrapolate and see how much growth potential eCommerce has to offer over the next few years.

It is hard to find a solid reason and a convincing, defensible argument to keep these brick and mortar retail businesses alive. In a way, it is not too dissimilar to imagine the death of the taxi industry once safe and autonomous cars will start picking you up to take you to perhaps the last Macy’s store on earth. Remember when we used to go to Blockbuster to grab a DVD movie for a nice weekend night with the family?