By Chris Kocher, Blue Dots Project Partner and Co-founder & Managing Director, Grey Heron. This article was originally published in the Sand Hill Group newsletter, October 26, 2017.

Amazon is pursuing new markets and disrupting multiple industries at an incredible pace. Almost every business seems to be in its crosshairs. Companies and industries that once thought they were safe are now worried about being “Amazoned”: apparel, groceries, entertainment, IT, automotive, pharmaceuticals, real estate – you name the business and you’ll find some fretting executives.

To better understand Amazon’s initiatives in these and other categories, it’s important to understand their strategies, analyze their announcements, read between the lines of their product offerings and assess their patent filings. In order to provide greater context for all of these Amazon monetization initiatives, I’ll categorize and assess them through the lens of the Four Values Framework™ described below.

Evolution of an Online Bookseller

Most people think of Amazon as a large, online, ecommerce marketplace with Prime two-day shipping and as a Cloud service provider with Amazon Web Services (AWS). Many people were surprised by the $13.7 billion Whole Foods acquisition. But, that is just the tip of the iceberg for the eCommerce juggernaut.

To give you an idea of how big Amazon is, it now employs over 382,000 people. It added more than 100,000 new hires in the last 12 months – a total greater than that of all but four states in the US. It also has a warehouse or distribution point within 20 miles of 63% of the US population and revenues are running over $150 billion annually. It accounted for about 43% of all online spending in the U.S in 2016 and is expected to approach 50% by the end of 2017.

Amazon aggressively invests in new technologies and continuously innovates with new products, software and services at a very rapid pace. Most importantly, it’s obsessed with being customer centric – a core company value that is probably one of its most underappreciated strengths. Too many tech companies miss the boat when they focus on technology and competitors rather than customer needs and behaviors.

A Unique Value-Creation Engine

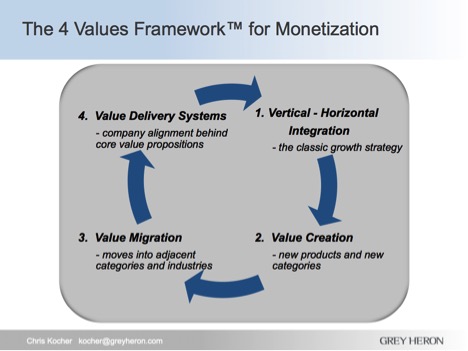

The Four Values Framework (4Vs)* is Grey Heron’s structured approach to developing new growth and monetization strategies for our clients. It provides context on how Amazon, or any other company, builds new offerings, creates value and increases shareholder returns. Let’s look at how Amazon is creating new value in four ways:

Vertical – Horizontal Integration

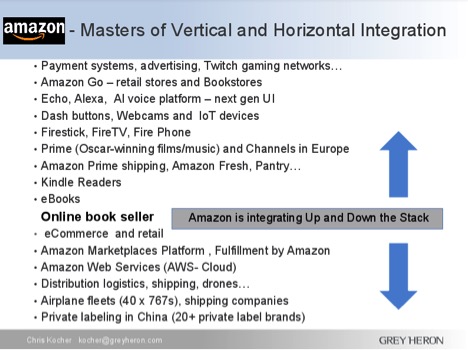

Over the last 20 years, Amazon has done a masterful job of monetizing value via horizontal and vertical integration. It leverages its strengths in logistics and shipping to integrate backwards as well as to get into new markets. It has also acquired and partnered with multiple companies to flesh out its offerings, build out product lines and expand into new categories.

Amazon transitioned from being a simple reseller of physical books online to what some people refer to as the “Everything Store.” It has moved into many different categories and industries effectively leveraging its strengths with new business models and technologies that are disrupting everything.

As depicted in the chart below, Amazon has integrated vertically back, through its supply chain, as well as forward, towards its customers. It parlayed its ability to sell books online, into an ecommerce platform selling many different products and then into an ecommerce marketplace. Amazon Market Places now has over two million merchants that sell over $100 billion in third party goods for which Amazon receives 14-40% in fees.

Then Amazon leveraged its expertise in high volume, seasonal ecommerce systems with redundant data centers into Amazon Web Services (AWS) cloud offering which is now a $16 billion business. That is bigger than Microsoft and Google’s cloud offerings, and makes them one of the biggest IT providers in the world. Even two years ago, Amazon was pushing companies like HP and IBM out of the public Cloud business (see HP Surrenders Public Cloud as Amazon Gobbles up Everything).

In addition, Amazon has leveraged its investments in AWS to tap into the very rapidly growing Internet of Things (IoT) area. They have produced everything from Amazon Dash Buttons to allow one-touch product ordering to a whole line of products to attract developers onto their IoT AWS platforms. (For more detail on the depth of the AWS and IoT initiatives, see: Amazon Developments in IoT: A Force to Be Reckoned With).

Since Amazon spends 6-9% of revenues on shipping, they continually refine everything they do to optimize their warehouse, distribution and logistics systems. They acquired Kiva in 2012 for $775 million to obtain robotics technology and now deploy over 40,000 robots to help automate their distribution centers. They leased 40 Boeing 767 jets for Prime Air to supplement UPS and Fed Ex delivery capacity. And they even use the US Postal Service for Sunday deliveries.

In striving to optimize logistics and reduce shipping costs they have integrated vertically all the way back through their supply chain. Understanding exactly what they need/want as an eCommerce customer has made them extremely competitive in distribution, logistics and multimodal transportation.

Amazon created Fulfillment by Amazon (FBA) back in 2013 to help integrate shipping for its merchants. In 2016 this was expanded into the even more ambitious Global Supply Chain by Amazon. Now they even have a Chinese freight forwarding subsidiary, Beijing Century Joyo Courier Services, to further streamline the delivery of goods from China. As they continue to provide Logistics as a Service (LaaS), Colin Sebastian, an analyst at Robert W. Baird & Co suggested Amazon could earn as much as $400B in future revenues from the trillion-dollar shipping industry.

Amazon is also pioneering and patenting numerous aspects of drone delivery with tests ongoing in the UK. They also have a development team based in Paris that is developing a drone air traffic control system in anticipation of the need for drone avoidance and control systems.

They have even patented the concept of an Airborne Fulfillment Center (AFC), a blimp like vehicle that could be used to warehouse items above metropolitan areas at up to 45,000 feet. Products could be delivered from the AFC within minutes via drones dropping from the sky. Sounds like a futuristic concept but it shows how Amazon is willing to risk investments in many alternative technologies that can reduce costs and add value to their business in the future.

Amazon mastered the entire supply chain from one-click ordering on the front end of their marketplaces all the way back to the shipping from manufacturers. Their next step was to start producing their own private label brands of clothes and household items. They now have dozens of private label brands that range from batteries to baby wipes and shoes to sweaters.

They have two enormous advantages with these private labels. First, they know their customers intimately from what they order, how they order, what their preferences are, how they pay, where they live, what sizes they wear, and what the most popular products are. This let’s Amazon decide which types of items they want to build private label products around that will maximize sales and profitability.

Secondly, they don’t need to spend a lot on advertising and awareness like most major brands sold at retail. Amazon simply makes sure their private label brands are displayed in online searches when any of their tens of millions of shoppers and Prime members are looking on the Amazon website for related products.

To extend this advantage, Amazon recently filed patents for on-demand custom manufactured clothing machines. This concept revolves around machines that could automatically cut and sew/assemble bespoke clothing to order.

They also introduced the Echo Look “Hands-Free Camera and Style Assistant” a few months ago. In effect it is “a kind of digital fashion adviser, allowing people to upload photographs of themselves to get style recommendations through a combination of software algorithms and human fashion specialists.”

In short, a person could take a picture of themselves with the Echo Look, provide measurements (which Amazon may already know from previous clothing orders), see a photo of themselves in the clothing, change colors or garments, order the desired items and then Amazon’s patented machines could cut and assemble the clothing. These would then be packed and shipped to a customer’s door- perhaps in a couple of days.

Combining the two of these capabilities together in the future will give Amazon a unique advantage in being able to disrupt the entire apparel industry. No surprise that various apparel and retailer’s stocks get hit hard every time Amazon makes a new announcement in this area.

As we can see from Amazon’s vertical/backward integration, this strategy has enabled it to manage and monetize everything from identifying potential customers they attract to Amazon, to “one-click” ordering, payment, manufacturing, and delivery to the purchasers doorstep. Amazon has mastered this integration and is continuing to invest prodigious amounts of money into data science, machine learning and artificial intelligence to further optimize their offerings.

This approach has enabled them to squeeze even more profit out of the value chain. It leverages their unique understanding of customer needs and buying behaviors to offer exactly what customers want and deliver it through their own end-to-end supply chain. Amazon has also been able to spin out some of these offerings to the market like AWS to increase revenues and gain additional economies of scale.

Lessons for Software Makers

Although not all of Amazon’s initiatives in Vertical and Horizontal Integration will apply to all of your businesses, there are a few core lessons for the software industry:

- Be absolutely customer-centric – focus on owning the customer relationship

- Create platforms if possible to leverage/monetize ecosystem partners (Amazon marketplaces)

- Leverage infrastructure built to support your offerings for new services (AWS and IoT)

- Pursue self-service platforms that can scale (Marketplaces, AWS and IoT)

- Exploit Big Data and small data to identify new opportunities (Private label brands)

- Relentlessly optimize your supply chain and leverage economies of scale

Chris Kocher is a co-founder of Grey Heron, a management and strategic marketing consulting firm. He has 30 years in both strategic and hands-on operating experience helping executives and investors build revenues and shareholder value. He has consulted with over 130 companies on innovating with new business models, product strategies and monetization. Chris has held management positions at HP and Symantec in addition to advisory roles at startups. He has worked extensively on monetization, SAAS, IoT, ecosystems, partnerships and accelerating growth in new business initiatives. Email him at kocher@greyheron.com or follow him on LinkedIn.

* The Four Values Framework (4Vs)™ is a structured approach to developing new growth and monetization strategies developed by Grey Heron Venture Consulting. It has been used with multiple companies to identify Vertical and Horizontal integration approaches, new Value Creation areas, Value Migration into new markets and product categories as well as building complete Value Delivery Systems to ensure strategic alignment.