Hats or hair… which is the better growth strategy?

Choosing between organic versus inorganic growth is a fundamental strategic decision with enormous impact. Looking back at their acquisitions, 82% of board members believe that their decisions resulted in success. Instead, the sobering reality is that 83% of acquisitions fail to increase shareholder value and 53% destroy value [1].

As we think about how to make M&A decisions that reliably increase valuations, we can start with a metaphoric framework. Let’s say that hair represents organic growth, and hats symbolize inorganic growth [2]. A strategy that relies on growing hair has the potential advantages of greater control and consistency at a lower cost versus going on a shopping spree. The primary disadvantage is that it takes a long time to grow a luxurious and lustrous mane. So, when faster growth is essential or a company lacks the appropriate tonic to stimulate hair growth, companies often turn to acquisitions. Whatever the underlying growth issues may be, the inorganic strategy enables acquirers to shop for hats to cover up problem hair relatively quickly and present a more appealing look to investors.

The volume of M&A activity last year reinforces that the hat strategy remains popular. Globally, in 2016 there were 17,369 M&A deals reported. The cumulative transaction value was between $3.2 Trillion and $3.9 Trillion, the third highest year on record and a sum equal to over 4.5% of global GDP [3]. The low cost of capital, lackluster economic growth, and aggressive cross-border investing by China largely countered the downward M&A pressure exerted by the uncertain socio-political climate in the U.S., EU, and elsewhere. How big were China’s 2016 outbound acquisitions? $185 Billion, a triple-digit percentage increase from 2015 [4].

So, after decades of experience and hundreds of thousands of deals, why do so many M&A transactions yield disappointing results and how can a potential acquirer avoid buying the wrong hat? After all, unlike buying online from Hats.com, it is expensive and embarrassing to return a corporate hat that proved to be a bad purchase with a poor outcome.

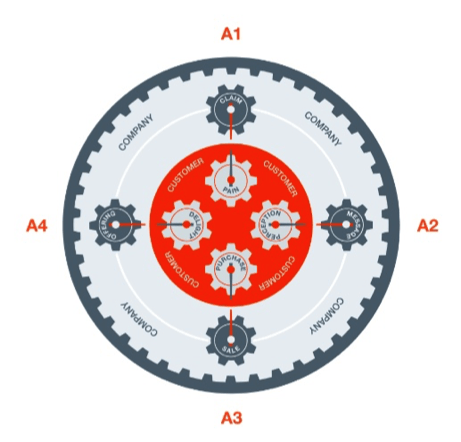

The root of disappointing acquisitions is found in the misalignment between an acquiring company and its acquisition candidates. Fortunately, there are ways to reduce risk and improve outcomes by supplementing existing M&A analysis with a level of rigor based on alignment. The Blue Dots A4™ methodology provides a reliable and comprehensive alignment guidebook to evaluate candidates; perform due diligence and anticipate challenges; develop post-acquisition integration and operating plans; and inform the ultimate go / no-go decision.

The Blue Dots A4™ methodology provides a reliable and comprehensive alignment guidebook to evaluate candidates; perform due diligence and anticipate challenges; develop post-acquisition integration and operating plans; and inform the ultimate go / no-go decision.

A4 powers a methodical, fact-based alignment measurement across four axes essential for success. The analysis reveals whether an acquisition candidate:

- 1. Markets products or services that kill significant, motivating customer pain;

- 2. Communicates messages that are clearly understood, relevant and compelling;

- 3. Supports effective marketing and frictionless go-to-market; and

- 4. Creates bankable customer delight

With the A4 analysis results, an acquirer can clearly see where strong alignments can generate synergies and leverage in terms of Strategy, Operations, People, and Financial Performance. Or, when significant alignment gaps are identified, choose to pass on the candidate or at least understand the gaps and develop action plans to close them.

We can all cite role models for both great M&A outcomes among well-aligned companies and disastrous results following transactions where major alignment gaps were undiscovered or ignored. We can admire deals such as Disney + Pixar + Marvel and Exxon + Mobil. Or we can shake our heads recalling Time Warner + AOL, HP + Autonomy, and Daimler + Chrysler.

A thorough alignment assessment and action plan is one sure way to improve the odds of acquisitions more consistently producing intended results. When it comes to growing by acquisition, it is far better to be aligned in advance than maligned for buying the wrong hat.

[1] KPMG, Mergers & Acquisitions – a Global Research Report, 12/1/1999.

[2] Courtesy of Investopedia.

[3] Mergermarket 2016 Global Trend Report, 1/4/2017, J.P. Morgan 2017 M&A Global Outlook, 1/2017, and Dealogic / IMF forecasts as of 2/10/17.

[4] Dealogic as of 12/31/16.