Growth is the master. Success is its slave.

thatAt Blue Dots, we are religious about top-line revenue growth (of course relative to the target market growth) and how to optimize it using our proprietary A4™ Precision Alignment Methodology.

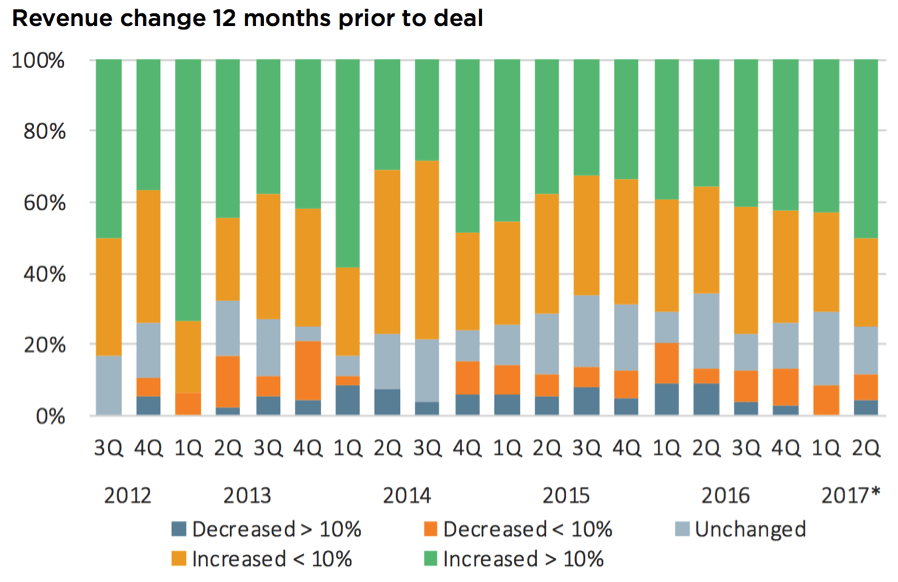

PitchBook recently published the results of a survey of 96 respondents who have completed a financial transaction between January and May of 2017. One of the most interesting takeaways was that Private Equity (PE) firms tend to increasingly target companies with a trailing 12-month revenue growth of at least 10% across all sectors. Note that revenue growth was strongest in the IT sector, which represents about 20% of all PE deals.

Source: PitchBook as of 5/23/2017.

Source: PitchBook as of 5/23/2017.

In April 2014, McKinsey published an article entitled “Grow fast or die slow” based on research made on 3,000 software and online services companies and their business cycles between 1980 and 2012. Key insights from the article shed light on the fact that:

- High growth generates significantly better shareholder value (5 times) compared to medium growth companies.

- Success can be predicted by growth: companies with growth over 60% at the time they reached $100M in revenue were 8X more likely to reach $1B in revenue compared to those growing at less than 20%.

- Growth matters more than margin or cost structure in terms of shareholder value creation.

The article also emphasized that sustaining growth is hard: 85% of the high-growth companies did not maintain their growth rate of at least 60%.

Growth fuels success. Growing faster than the market in which a company operates remains, in our opinion, the only way to generate sustainable shareholder value. This is why we made it our core focus and obsession at Blue Dots.