What happened to Nasty Gal?

Nasty Gal was an online fashion store that was selling its own collection and other brand items of edgy, stylish clothing, accessories and shoes. The highflying Los Angeles-based company was founded in November 2006 by the très charismatic, once described as the “Cinderella of tech”, Sophia Amoruso. She dropped out of a community college and was 22 then. In March 2012, the company raised its first Series A round of financing of $9M led by Index Ventures. The company went on to raise two subsequent rounds and brought in a total of $65M of capital, including nearly $50M that came from Index Ventures alone.

The name of the company is indicative of the mindset of Amoruso. Last year, in an August article in the Los Angeles Times, she was quoted saying: “If it’s a big shock when you hear it, you’re probably not our customer anyway.” The name actually came from a 1975 song by Betty Davis.

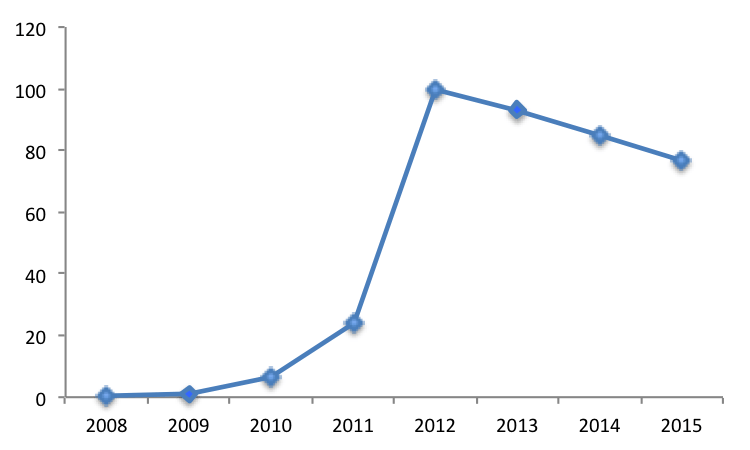

Between 2008 and 2012, the company reportedly grew from very little revenue ($200K) in 2008 to about $100M in 2012. In June of last year, Forbes estimated that the company did over $300M in sales in 2015, which was grossly over over-estimated. This is an amazing top-line growth that would cause any entrepreneur or investor to salivate. Then the wheels fell off the cart. Revenue dropped rapidly and continuously to $77M in 2015. The company was not able to raise additional capital and filed for Chapter 11 bankruptcy protection in November 2016. It ended up selling its brand in February this year to UK-based Boohoo.com for just $20 million.

Nasty Gal revenue in $ millions (source: compilation of various published articles)

What went wrong?

It is true that Nasty Gal spent a huge amount of cash ahead of demand and revenue: it established a large 500,000 square foot distribution center in Shepherdsville, Kentucky, built a lavish headquarter for 200 employees in downtown Los Angeles. It also faced some costly legal battles: claims of copying Givenchy’s Rottweiler tote, trademark infringements, employee discrimination and wrongful terminations. Some employees described the work environment as toxic. The company also spent a huge amount of money marketing to their target market and the cost of customer acquisition skyrocketed. To contain cash flow, it went through two rounds of layoffs: the first in 2014 and the second in early 2016.

If you visit our website, the very first word and possibly the most important one is the adjective “sustainable”. As Nasty Gal proved, one can create a company with tremendous growth, but if the cost of acquiring and/or servicing a customer is too high and if the CEO cannot continue to raise significant sums of money to fuel that growth, then the company spirals downs to end at fraction of its peak value.

But the profound reason for the company’s demise is a combination of two misalignments identified in our methodology: A1 (pain versus claim) and A4 (expected versus delivered delight).

What market segment was Nasty Gal after? The company’s products were most appealing to a distinctive type of Gen Z and millennials with particular tastes and aesthetic inspirations. It is too much of a micro-community and the company can never go mainstream with that market segment. There are simply not enough prospects with the pain to build a real business. The other interesting dynamic is that the more popular the company is, the smaller the market becomes. The paradox indeed is that at the beginning, not everybody knew about the brand and the early customers felt special and excited about the new products, but once awareness grew, the cool factor vanished. Cool is ephemeral.

The second misalignment was related to what we, at Blue Dots, call the “Delightfulness Journey”. We always contend that, at the end of the day, every company is in the business of manufacturing delight, be it a small specialty semiconductor equipment shop in Oklahoma or United Airlines. Nasty Gal spent significant amounts on paid eCommerce acquisition, which is an expensive and non-scalable way to attract net new customers. This acquisition strategy only can work for a “hero” product or high gross margin items. Ultimately, repeat transactions are the only way to make the business model work and scale. The attractiveness of a product on the screen was high (it looked amazing), but when customers received the product, it did not feel as high quality and it did not look as good. Perceived low product quality and value made it hard for customers to buy again. Their delight expectation was not met and loyalty never really materialized.

Some have raised the question about the founder turning from an entrepreneur to a Hollywood celebrity with her own agent and personal publicist, her own book (#GirlBoss), and a Netflix show (GirlBoss). Some argue that Amoruso’s activities outside Nasty Gal were the reason the company failed. I don’t subscribe to this view.

The fundamental misalignment that caused the company’s demise was that top-line revenue growth was not aligned with the expenses the company incurred to build and support that growth. It a way, it was artificial and like “buying” revenue. That broke the sustainability rule. I sometimes wonder if Tesla, albeit at a much different scale, is not going to face the same challenge. Ultimately, products have to generate high enough gross margins and business must exhibit repeatable profits. Sometime though investors are patient enough and the payoff is tremendous. It took 7 years for Amazon to post its first profitable quarter with $5M profits on revenues over $1B (Q4 2001). However, sustainable profitability did not happen until Q1 2016 and Amazon may be on its way to become the most valuable company on earth with a current market cap of $475B. You would have made 90X your money if you had bought shares of Amazon when it turned its first profit at $11 per share and sold them today at $990 per share.