IoT: Where is the money? – Part 2

In my previous article on monetizing IoT, I described some of the key drivers of the IoT, the 10 main IoT areas, the importance of ecosystems and major considerations for monetizing IoT. In this follow-on article, I’ll focus on the 4 Values Framework that we’ve used to help many of our clients define their IoT strategies. It can help both large established companies as well as emerging startups think through how they can best monetize their IoT opportunities.

There are many ways to leverage the IoT to create greater value for your customers and increase revenue streams and cost savings for your company. Each industry, ecosystem, technology or customer segment will present unique opportunities. There is no one right way to monetize the IoT.

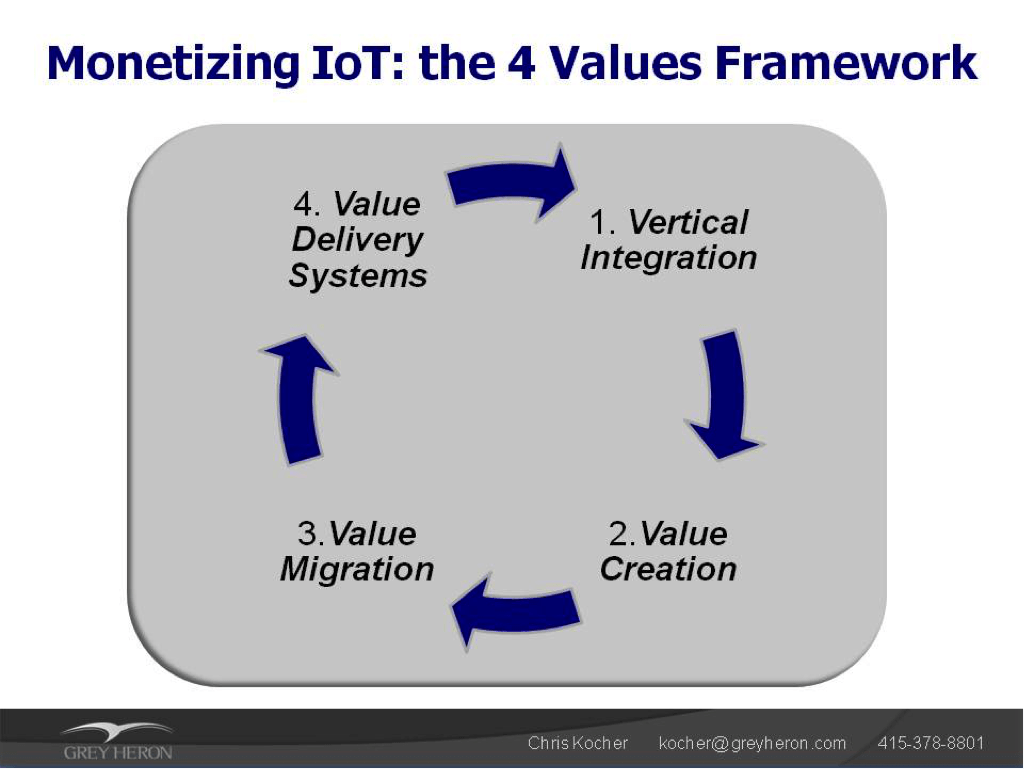

In that light, we’ve found that the 4 Vs Framework is a good approach to identify, prioritize and ensure you can deliver on IoT opportunities. It is a straightforward, structured process to look at four areas that will help you refine your IoT strategy and decide how best to monetize those opportunities. Understanding ecosystems, potential partners and competitors is an integral part of this process.

The figure below highlights the components of the 4 Vs Framework: vertical integration, value creation, value migration and value delivery systems. I’ll describe the components below and give an example for each.

Vertical integration

This is the classic approach of looking at suppliers, channels and ecosystem partners that are all part of your value chain and better integrating or acquiring them to provide new offerings and value to your customers.

A great example of this is the way Dell is approaching the IoT. With billions of IoT devices to be deployed in the coming years, Dell is taking a vertical approach and extending its product offering down to new IOT-distributed devices while leveraging its ability to store, analyze and manage massive amounts of data on its bigger systems.

Dell recently announced its new IoT Edge Gateway device. It will exist close to these IoT devices, communicate with them through various communication protocols, aggregate the data, perhaps perform some basic calculations and then forward that data on to other servers and storage systems. This approach leverages Dell’s existing customer relationships and provides them with new offerings to help them implement IoT. Dell is not trying to create new communication protocols, new sensors or new ways to do business. Rather, it will partner with other major players in the ecosystem to implement whatever is needed to build complete solutions.

This is a low risk, don’t-rock-the-boat, play-nice-with-your-partners approach. It is the easiest and most logical product-line extension approach to the IoT. Just embrace and extend.

In a similar vertical integration strategy, Citrix acquired Octoblu last year. Citrix is known for desktop virtualization, SaaS, cloud and networking for enterprises. It obtained some brilliant talent as well as the Octoblu platform, which will allow the multitude of new IoT devices to communicate with each other over numerous evolving communication protocols. With this Rosetta-stone-like offering, using an M&A approach, Citrix launched itself into the IoT business through a vertical integration strategy.

For young emerging IoT growth companies, being acquired by an ecosystem partner is a fast track to liquidity. For large incumbent companies, M&A can be a way to overcome a lack of internal expertise, leapfrog competitors and accelerate time to market in the IoT.

Value creation

This strategy in its simplest form is a mashup approach. It combines many parts of existing products, technologies, systems, partner offerings and business models to come up with entirely new value. It takes more work but has the potential for greater reward. A value creation strategy requires deeply understanding customer issues, problems and needs and then using the IoT to create entirely new solutions that help customers in dramatic new ways. Developing customer-journey maps is a helpful way to focus in on and clarify customer issues in this process.

This type of value-creation approach may require creative brainstorming, special partnering or a vertical market approach in a B2B business, or OEM relationships to build integrated, “whole-product” solutions for consumer offerings.

In many cases, the partnering, integration, delivery and business model may be as important or more so than just the technology itself. This type of value creation often requires more investment, more risk, more ownership of complete solutions, more handholding and customization and a longer time to deliver these kinds of comprehensive solutions. But it also has much greater upside if you can build and own a new product/category area.

A great example of this is Uber. Although many people think of it as a taxi replacement service, in fact it is really an on-demand logistics company. Uber started with a new way to order car service and moved into ridesharing, rapid delivery services to your door, food delivery with Uber Eats, various marketing and event activities they use to drive promotions, and is even talking about being able to deliver flu shots (presumably with a nurse who comes to your location).

Uber really has not created anything fundamentally new. However, it has integrated a number of systems to create substantial new value – $50 billion+ at its last valuation. Uber developed an easy-to-use mobile app, combined it with a very sophisticated logistics back-end, location and navigation capability, integrated payment systems, added a social rating system and signed up drivers with their own cars. In the future, with driverless cars it will undoubtedly morph its business model and tactics further to be even more profitable.

By themselves, none of these are new technologies. But Uber did a masterful job of integrating all of them and other pieces of the value chain to provide a very effective, low-cost, high-margin, scalable business model that has very high value creation. Although this all sounds great, it is not for the faint of heart. It is high risk and can take a long time to build. Within the IoT space, we will see numerous similar value-creation approaches in connected homes, smart cars, intelligent cities, eHealthcare, insurance, etc.

How does this play for small companies? There may be opportunities to partner with these value-creation players. However, it is like dancing with elephants; you never know when they will choose to work with a competitor that offers your services/products at a cheaper price or if they decide to build it in house as they scale. So these may be coopetition opportunities.

In follow-ups to this article, I’ll focus on the last two components of the 4 Values Framework: value migration and value delivery systems. I’ll also conclude with eight key things to consider as you evolve your IoT monetization strategies.