Go green… Evergreen: the enduring company structure alternative

Many of us have been fortunate to live the dream of the “Valley” success story of an IPO or big acquisition. The path to one of those targeted exits is no small feat. It requires the convergence of market timing, an outstanding team, and no small amount of luck. But is locking into those exit strategies really the only… or even the best outcome?

Not for those who have chosen another, totally different path to success. Hundreds of low-tech companies have proved that a business can remain private; avoid taking on venture, private equity, and other traditional investors; and thrive over a period of years, decades, and even generations. Dave Whorton, longtime Silicon Valley investor and founder of the Tugboat Group, has termed these businesses “Evergreen” companies. Dave defines them as enduring profitable businesses that avoid raising the capital that can put money before mission and impose a growth-at-all-costs or exit-oriented mindset.

The questions we want to pose in this article are whether pursuing an evergreen strategy is a legitimate, desirable and feasible choice for tech companies. We believe the answer is a resounding “yes”. It is a very attractive option for founders and leadership teams that want greater control of their destiny and have the desire and stamina to build lasting value. In the race to an exit, it’s easy to forget just how big the footprint is for private businesses. Over two-thirds of employment and nearly 57% of revenue in the private sector of the U.S. economy are generated by privately held firms [1]. 115 private companies have revenue in excess of $5B [2]. Within that powerful economic engine, many of the best examples of Evergreen firms are found in family-owned businesses, which comprise an impressive 35 percent of all the companies listed on the S & P 500 or the Fortune 500 index [3].

Being an Evergreen company is no accident. Remaining private and independent is a fundamental choice driven by personal and economic influences and it is not an easy path. Attracting capital, incentivizing employees, and overcoming concerns among prospective customers can all be daunting challenges. However, there are also multiple financial and psychic advantages to going Evergreen. One core factor is the ability for founders and management to maintain their focus and avoid many of the distractions and pressure points of becoming or being acquired by a public company. For example, in the early stages of a company’s life, Evergreen firms escape the cycle of constant venture fund-raising and monthly board meetings that can drain critical management time that could be dedicated to building foundational infrastructure, talent, and momentum. Later, when scale, expansion, and steady growth are the focus, Evergreen entities dodge many of the painful public company obligations including managing market expectations, performing unnatural acts to achieve quarterly targets, and devoting time and expense to financial compliance and reporting requirements.

Freed from public company constraints, Evergreen companies are often more aggressive in terms of capital investment and generate faster growth and higher profits. In a Sageworks study for the years 2010 through 2014, privately held U.S. companies with more than $500 million in annual revenues grew sales 13.8% versus 3.3% for public companies. Revenue growth wasn’t the only achievement though: they also generated slightly higher net profit margins every year [4]. The same is true for family-owned firms, which consistently demonstrate higher employment, revenue growth and profitability versus nonfamily businesses. The average profit margin for family firms was ten percent, two percent higher than non family companies [5]. Family companies are also able to grow their capital asset base faster. On average, private firms invest nearly 10% of total assets a year compared to only 4% among public firms, a 2012 Harvard Business School/NYU study found [6]. The study suggests that short-term goals drive public-company conservatism when it comes to investment opportunities [7].

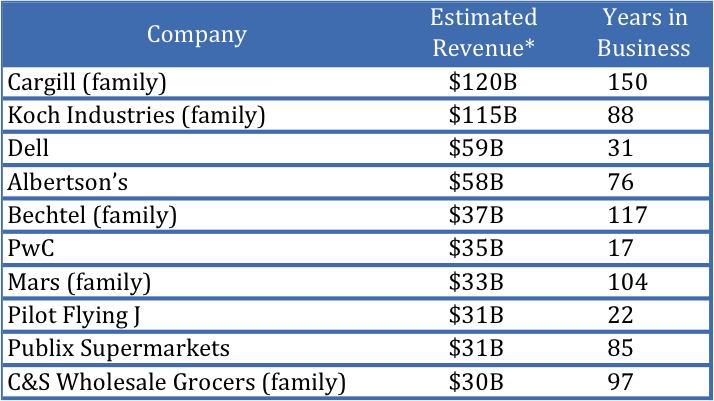

So, who are these companies that have proven that it pays to be Evergreen? Half of the ten largest private U.S. companies are family owned. Only one of the top ten, Dell, is high tech. The average age of these ten companies is 79 years and, for the family companies, 111 years! These are truly companies built to last.

*Forbes 2015 Ranking of America’s Largest Private Companies.

Because Dell is the only private tech company in the top ten, one could ask whether tech companies can succeed as true Evergreen enterprises. The answer is “yes” and there are plenty of proof points. Four Evergreen tech companies are in the $6B – $7B revenue range and have been in business at least 25 years. They include SHI International, Kingston Technology, World Wide Technology, and Medline Industries. In the $3B revenue range, Bose and Vizio have been building their businesses for 51 years and 13 years, respectively. The list goes on including Sungard Data Systems ($2.8B, 33 years in business) and many more.

Our conclusion is that for tech companies, if the founders want to go Evergreen, the path is wide open. So, when you or your colleagues want to pursue the next great start-up idea, before adopting the traditional Valley approach, at least give consideration to the road less traveled.

[1] Mary Ellen Biery, Sageworks

[2] Forbes

[3] Blackwell Publishing, Ltd.

[4] Graham Winfrey, Inc. and Sageworks

[5] Family Business Review, Jim Lee, PhD

[6] Harvard Business School, Joan Farre-Mensa, assistant professor

[7] Ellen Biery, Sageworks