The two types of businesses

What type is your business?

In the 1950’s, Meyer Friedman and Ray Rosenman came up with two personality behavior traits, called Type A and Type B, to segment people with a higher risk of coronary heart disease. While the medical study has remained controversial, the two types of individuals are still used today.

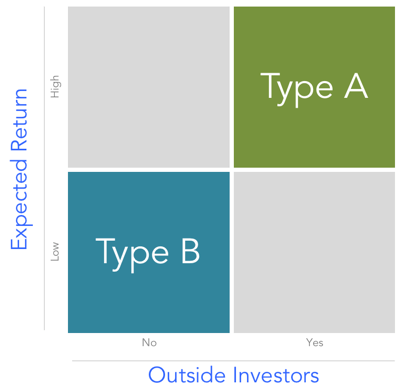

Like personalities, I believe there are two different types of businesses: Type A and Type B businesses. Type A businesses tend to me more competitive, they are driven by a sense of urgency and are more aggressive. Type B businesses tend to me more measured, patient and easy going.

Let’s start by examining the second type of business, Type B businesses.

Type B businesses

There are the many small, sometimes family-owned “mom and pop” businesses in the US. They are very important to the US economy. According to the U.S. Census Bureau, there were, in 2014, 5.2 million employer firms with less than 20 workers, making up 89% of businesses. If you add the non-employer businesses, then they represent 98% of all businesses.

These businesses are typically owned by one or several individuals. Examples of Type B businesses are dentist practices, small gardening / yard servicing companies, solo-practitioner consultants, pet stores, family owned restaurants, small divorce attorney practices or mechanic shops.

Are these businesses designed or destined to grow? The answer is typically no. They are not subject to the Three Laws of Business, because they don’t typically have shareholders. A restaurant is not going to double the number of tables or its price to double its revenue.

So, for Type B businesses, the job of the manager / owner is to maintain a predictable cash flow, so that they and their family can live off that cash flow and perhaps pass it off to the next generation.

What about Type A businesses?

There is a very different type of business. The ones that make Silicon Valley and investors tick. They incarnate the full expression of capitalism. I call them Type A.

The Founders’ / CEO’s goal is to transform an idea, or small business into a large vibrant enterprise, generating an increasing amount of revenue while, at some point, controlling expenses to reach a stage or sustained profitability and cash flow generation. At that stage, they reached a certain level of freedom: no need to raise another dollar of funding.

A key characteristic of Type A businesses is that they typically have investors, from angels to VCs to large Private Equity (PE) firms who help fund the early stage of the business or a growth phase. The CEO’s goal is to make their investors (including themselves) rich, so that these investors can raise another fund to invest in the next generation and keep the flywheel turning.

The two types of businesses

Type A businesses are, in the early-stage of their lives, very dynamic, nimble and aggressive. It is not uncommon in Silicon Valley to observe a company grow from 12 employees one year to 80 employees the following year and within a few years, see its headcount reach several hundred employees. These corporations rise fast and, in many cases, crash and burn at a mind-blowing speed as well.

They represent the dream. The pursuit of being, one day, a Google, a Facebook or an Apple. The dream of making a dent in the universe. It is the fear of losing the opportunity for an investor to be associated with of these potential unicorns that has driven VC firms around the world to invest $152.5 billion in 11,035 companies in 2017 alone [source: KPMG Enterprise – Venture Pulse Reports for 2017]. That year, according to the NVCA (National Venture Capital Association), venture capital activity in the United States reached its highest level since the turn of the millennium with about 900 VC firms in existence.

Let’s not be mistaken: even after raising seed financing, the casualty rate is very high. In March 2017, CB Insights analyzed a cohort of 1,098 tech companies headquartered in the US that raised a seed financing in 2008, 2009 or 2010. They followed these companies until February 2017 to give them enough time to go through their lifecycles. It turns out that 46% of them raised a second round of financing and 28% exited through an M&A or IPO within 6 rounds of funding. Some of these liquidity events produced great multiple to investors while other were money losing exits. Only 32 of the cohort had an exit with a valuation over $50 million. If we consider these as financially successful exists, it means that a mere 2.9% of the companies enjoyed a financially good exit for the investors.

In summary

There are two very different types of businesses. The motivations that drives entrepreneurs behind them are quite orthogonal. Both types of businesses are critical to creating a vibrant economy and while the spotlight tends to be on unicorns and fast-growing VC-backed companies raising hundreds of millions of dollars, small mom-and-pop businesses will continue to be the foundation of a healthy economy.