The value of revenue growth

The single most important factor in determining the valuation of a software company is the revenue growth rate.

In real estate what matters is location, location, location. In software it’s growth, growth, and growth.

Software companies are primarily valued based on revenue multiples. What drives the revenue multiple is expectations for future revenue growth and related profitability, which typically focuses on gross margins, not bottom line profitability.

While valuation for both traditional and Software as a Service (“SaaS”) models are based on the same concepts, over the last few years SaaS companies have been growing faster and commanding higher revenue multiples.

On-Premise vs. SaaS

In this blog post by Michael Aronow, according to the Software Industry Financial Report for Q3 2014 published by Software Equity Group, for the M&A market the median exit multiple for on-premise software companies was 2.4 x revenue and for SaaS companies the median was 4.1 x revenue.

It is interesting to note that on a TTM (trailing twelve months) basis, the M&A transactions with the highest multiples involved a large public or private acquirer (> $200M in revenue) acquiring small targets (<$20M in revenue) with median multiple of 3.4 x revenue looking at the total SaaS and on-premise acquisitions.

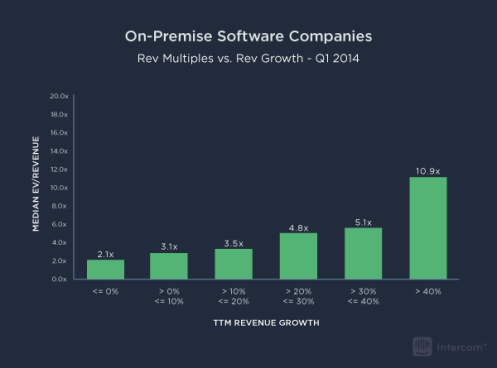

Information on historical and projected growth rates is not typically publicly available for M&A transactions. However, in Q3 2014, for publicly traded on-premise software companies the median revenue multiples for companies with TTM revenue growing between 0% and 10% was 3.1x and for companies with TTM revenue growing in excess of 40% was 4.9x.

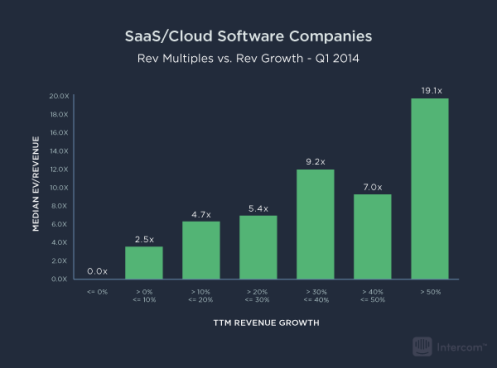

The difference in multiples is even more pronounced for SaaS companies where the median revenue multiples for companies with TTM revenue growing between 0% and 10% was 2.9x and for companies with TTM revenue growing in between 40% and 50% was 9.1x and growing in excess of 50% was 12.2x.

The graphs below, from the blog post by Anshul Shah, show the difference between On-Premise and SaaS in Q1 2014:

On-Premise

SaaS

The median revenue multiple for on-premise software companies that grew their annual revenue 30-40% is 5.1x, while the same multiple for a SaaS companies that grew revenue at that same 30-40% rate is 9.2x.

Dave Kellogg summarized the correlation between valuation and growth rates for SaaS companies in his blog post, with much of it restated here:

- 10% growth gets you an on-premises-like valuation of 2x (forward) revenues

- 20% growth gets you 3x

- 30% growth gets you 4x

- 50% growth gets you nearly 6x

Basically (growth rate % / 10) + 1 = forward revenue multiple.

What we know is that the growth rate in any given year is highly predictive of the growth rate in the next, whether the company is big or small, growing fast or growing slowly.

Declining Growth Rates

Andy Vitus of Scale Venture Partners wrote about revenue growth as a Valuation Framework for SaaS companies. He wrote that in a recurring-revenue business model, increasing the growth rate is exceptionally difficult; even maintaining the current level of revenue growth requires careful planning and great execution.

As a rule of thumb, therefore, next year’s growth rate is likely to be 85% of what this year’s was.

What is clear is that maintaining a high growth rate is key to getting a return that the a VC is looking for. In order to achieve a 5-10x return for investors over 5 years, a company must both start with, and substantially maintain, a high growth rate. Even starting with a 100% growth rate is insufficient if the growth rate declines at the typical 15% each year.

In a recurring revenue business the conclusions are stark: in order to build a meaningful business and deliver returns that will make your VCs happy, it is vital to maintain exceptionally high growth rates for an extended period of time. This is only achieved by brilliant execution as an early mover in a massive market.

Small Company Growing Slowly

What if you’re a small company growing slowly? While there is some satisfaction to be had from the annual increase in revenue, management teams are tempted to hope for (and often forecast) a sudden increase in growth rate.

Anyone who has tried to turn around a declining company knows firsthand that taking out costs is challenging, but it’s still much easier than reviving growth, which is harder to execute and requires different skills.

Low growth rates, however, are often a result of market conditions and more likely indicate a constrained market size (or some other unfavorable dynamic) than a dysfunctional sales organization. In these cases, capital efficient growth is crucial to deliver a good outcome and valuation.

Value of Profitability

You might think that profitability and getting to breakeven or better played some role in the valuation equation, but if you did, you’re wrong.

There’s basically no reward for profitability. Profitability will not generate the 10x return the investors are looking for. That’s only done through revenue growth.