The connected car: Fast…and a little furious

Cars are rapidly becoming vehicles for mobile information, commerce, and on-demand entertainment. Gartner predicts more than 250 million connected cars will be on the road in the next four years[1]. IoT is transforming what was simply a mechanism to get from Point A to Point B into a mobile living platform. GM’s CEO, Mary Barra, predicts that “The industry will experience more change in the next five years than it has in the last 50 years[2]”.

There are a few bumps in the road, though. The initial IoT focus has been integrating “ACEN” (audio, communication, entertainment and navigation) into connected dashboards. Yet, the just-released J.D. Power 2016 Vehicle Dependability Study shows that those efforts are also a major and growing source of problems.

ACEN features and services account for 20% of all customer-reported problems and the percentage is increasing. According to the J.D. Power study, “It is now the most problematic area on most vehicles and is the cause of the industry’s 3% year-over-year decline in vehicle dependability.” The problems stem primarily from usability issues that persist long after the first 90 days of ownership. Automakers have to listen to the feedback because only 41% of owners who experienced three or more vehicle problems remained loyal for their next purchase.

The survey’s bad news may influence the connected car ecosystem’s ACEN and overall IoT efforts but it won’t slow them down. Let’s look at just a few of the category players and progress.

- By mid-2015 Visa was already testing its Checkout technology to turn the car into a convenient and secure payment platform. Over the past two years, Visa partnered with Accenture, Honda, Pizza Hut, ParkWhiz, DocuSign and others to enable in-auto transactions ranging from lease and insurance contracts to retail purchases. At Mobile World Congress last week, Visa and Honda showed prototype software that helps drivers navigate to a nearby gas station, pay for the gas, and purchase items from the gas station’s store, all via a dashboard app. With ParkWhiz, Visa also demonstrated an app that enables parkers to pay the exact parking price without either under or over paying. This spring, Visa plans to test the fuel app in northern California and the parking app in New York City.

- One foundation for the connected car is reliable Wi-Fi. AT&T seems to have the pole position as they pursue multiple paths and relationships to deploy in-auto connectivity. Porsche is partnering with AT&T to provide 4G LTE Wi-Fi connectivity and information services beginning in 2017 as part of Porsche’s Connect Plus service. Audi is extending its AT&T connectivity partnership through at least 2018. In Europe, AT&T and Vodafone are working with several European automakers to provide mobile OnStar hotspots. There is no shortage of competitors, though, in the race to build connected car platforms. Android Auto, Apple’s CarPlay, Ericsson, and Geely Automotive, just to name a few.

- The automakers have their own strategies of course. At Mobile World Congress, Ford CEO Mark Fields said he wants the company to transition from being an automotive company to an auto and mobility company. Smart Mobility is Ford’s program to achieve that shift to “be a leader in connectivity, mobility, autonomous vehicles, customer experience, and data and analytics[3]”. By 2023, Ford expects 43 million vehicles to be using its Ford Sync in-vehicle connectivity technology to control entertainment, navigation, smartphone, and climate functions via voice commands.

- Then there are the Consumer Electronics companies that offer retrofit devices to capture sales without waiting for automakers to catch up. Among the giant CE players, Samsung’s Connect Auto dongle provides 4G Wi-Fi for up to nine people or devices. At the start-up level, Automatic’s dongle and smartphone app provide services ranging from driving feedback, parking location memory, fuel warnings, engine problem detection and more for model years 1996 forward.

- Even the fossil fuel companies want a piece of the action. Shell is partnering with Gordon Murray Design and Geo Technology to develop mobile payment services and other functions that will be available from in-car screens.

The industry doesn’t talk about it much but the data generated from the billions of auto-initiated transactions, entertainment choices, locations, etc. is where the true value of IoT lies. No wonder everyone wants a piece of this pie.

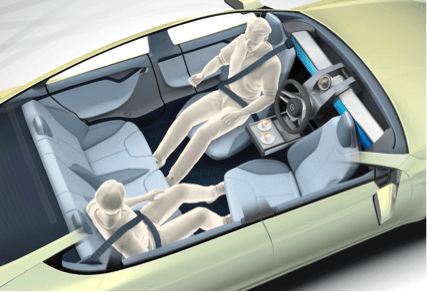

Eventually, many of these vendors and their products will fuel the race to autonomous cars. However, J.D. Power’s Renee Stephens (VP of U.S. Automotive) warns that “the industry clearly has more work to do to secure the trust of consumers. Right now, if consumers can’t rely on their vehicle to connect to their smartphone, or have faith that their navigation system will route them to their destination, they’re certainly not yet ready to trust that autonomous technology will keep their vehicle out of the ditch.”

[1] Gartner press release, 1/26/15.

[2] Address to the Chicago Economic Club, 3/12/15.

[3] Mobile World Daily, 2/23/16.