Three questions on revenue growth to Eric Dunn, CEO of Quicken

Last month, Philippe sat down with Eric Dunn, CEO of Quicken, at their Menlo Park offices, just down the street from Facebook. Eric has been part of the Quicken business since its early days. Eric joined Intuit, Quicken’s previous owner, as employee number four in 1986, when Quicken was the only Intuit software product. In March 2016, Intuit sold its Quicken personal finance software unit to majority owner H.I.G. Capital, a global private equity firm.

Can you describe the fastest revenue growth situation you have ever been involved with?

The fastest growth I have experienced was definitely at Intuit. It grew from $250K of revenue in 1985, the year before I joined, to $33 million in 1990, and then to $120M in 1993, the year it went public.

During its early years, Intuit was always profitable, with 80% gross margin for the software (shrink-wrapped boxes!) which accounted for 60% of revenue and 50% gross margins on the paper checks and envelopes which made up the other 40%. This mix of software and recurring revenue elements was by design and a key component of the success the company had and continues to enjoy. In the early days, however, growth was simply measured by the number of units sold.

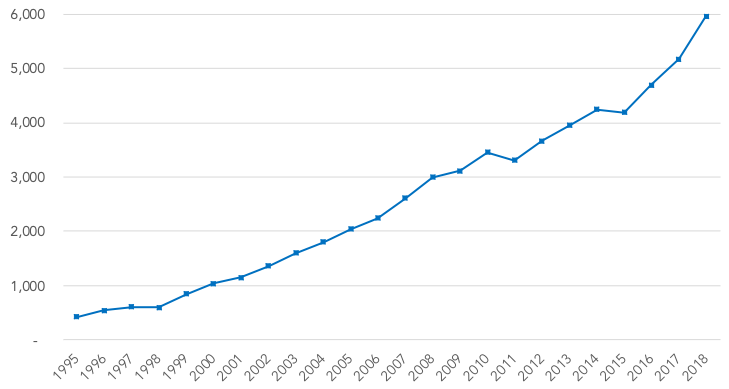

Intuit net revenue (in $ millions)

Today, Intuit enjoys excellent growth as a large public company, increasing revenue from over $4 billions in 2015 to around $6 billions last year.

What was the most daunting growth challenge you faced and the actions you took?

At Quicken, our durable challenge has been to innovate in the software we provide to meet the changing needs of personal finance users. Initially, the important unmet need was to allow consumers to use a PC to pay bills faster and keep track of expenses. Over time, the unmet need we have evolved to address is to give users control and visibility into their finances in a complex digital world.

However, the most daunting challenge we faced at Intuit / Quicken was when Microsoft announced their competitive personal finance product, Microsoft Money, in 1991. Microsoft had systemically wiped out successful, established software products such as Lotus 1-2-3, WordPerfect, and Freelance, so we had every reason to be alarmed. However, during 1991 a small Intuit team led by me and by Quicken’s current CTO, Tim Villanueva, was able to quickly develop a Windows version of our DOS Quicken product which was good enough to hold off Microsoft, which never got past 25% market share. Microsoft finally shut down Money in 2009.

What advice would you give to a CEO to accelerate the growth of his/her business?

Success comes when a company has a product customers want and out-executes the competition: you need both. Without product-market fit, even a superb team will grind to a halt. But executing well makes just as big a difference: Intuit’s founder Scott Cook quips that there were no fewer than 46 companies offering software to help people manage their finances in 1984, giving Quicken the “47th mover advantage.” But while the first Quicken product had one-third of the features the others offered, it had one major difference: it looked like a check register and a paper check, not like a spreadsheet, and so it was intuitive and easy to use.