Debt addiction

Drug dealers have long practiced the strategy of providing sufficient free drugs to eventually turn prospective “clients” into dependent addicts who provide a steady, dependable source of demand. While ubiquitous cheap money available since the Great Recession has not been truly free, it has been about as close to free as we are likely to see and has turned commercial borrowing into a mainline drug for corporations.

If debt were used primarily to fund business growth, then the justification for massive borrowing would be relatively straightforward. Instead, debt has often been used to boost share prices, generally via increased dividends and stock buy-backs.[1]

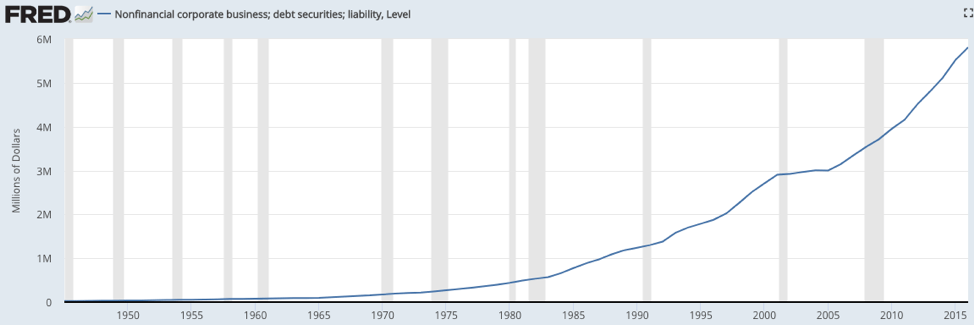

How much corporate debt is there? Let’s get two perspectives: absolute dollars tracked over time and as a proportion of GDP.

First, in dollar terms, we may be looking at nearly $9 Trillion in commercial debt in nonfinancial companies. According to the Federal Reserve in the chart below, in 2016 there was nearly $6 Trillion outstanding. The vertical gray bars indicate U.S. recession periods. Informa Financial Intelligence believes that borrowing by nonfinancial companies is up $1 trillion in two years and now stands at $8.7 trillion.[2]

Source: Federal Reserve Bank of St. Louis, 12/7/17.

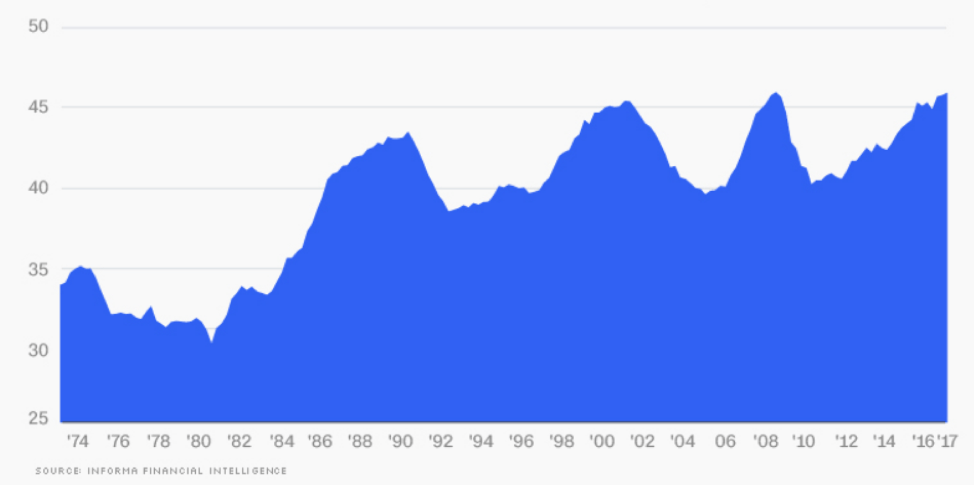

The second perspective is the relative comparison of corporate debt to GDP. Commercial debt now equals nearly half of the U.S. GDP.[3]

Corporate Debt-to-GDP Ratio

Source: Informa Financial Intelligence.

Despite the decreased cost of borrowing in recent years, the Debt Service Ratio (DSR) has remained relatively constant. As of June 2017, the DSR in the private non-financial sector stood at 14.8%, a decline of only 1.2 points since 1999. So, while the cost of debt decreased by roughly four times, massive borrowing meant the cost of debt service barely moved.[4]

Should we be concerned? Will there be an intervention in this drug crisis? Yes to both questions. Four factors are likely to impact debt strategies. First, the Fed is on course to increase interest rates moderately several times in 2018, making new borrowings more expensive. Second, the historic bull market is showing signs of fatigue and volatility, which as we have already seen threatens share prices. Share prices are particularly at risk for highly leveraged companies that fail to show productivity gains and real growth. Third, although we do not know the timing, we can say with certainty that there will be another recession. Companies with large debt overhangs and that are borrowing at increasing rates, need to be worried. Fourth, although the tax overhaul produced big benefits in terms of reduced corporate taxes, companies that have significant unpaid debt will suffer. Now interest expense is only deductible for up to 30% of its EBITDA. Companies may rein in borrowing but the questions are when and whether borrowers wait too long to kick the habit.

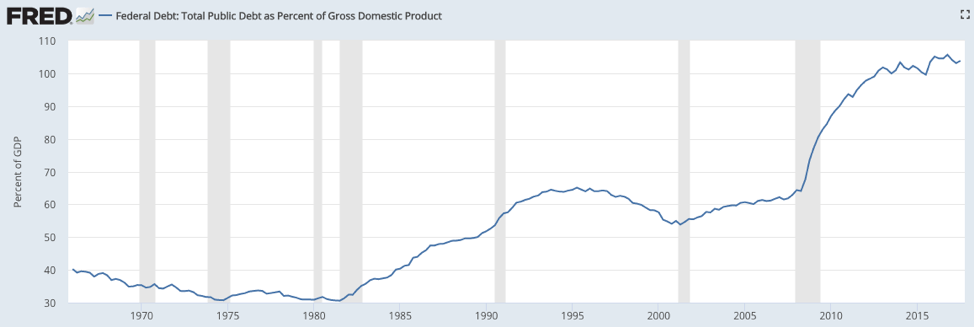

Of course we can count on some adult supervision from government in the form of setting a good example for debt, right? The chart below shows the history of federal borrowing through the third quarter of 2017. The debt binge that began during the Reagan administration (1981 – 1989) and that accelerated with the Great Recession, is now at 103.8% of GDP. Layering in another trillion dollars or more over the next few years, with economic growth of only 2% – 3%, may force us to shift to a logarithmic scale. Again, the gray vertical bars indicate periods of U.S. recessions.

Source: Federal Reserve Bank of St. Louis, 12/21/17.

Sometimes a herd needs a crisis to catalyze action. It is yet to be determined whether changes in corporate debt strategies will be proactive or reactive.

[1] David Ader, Chief Macro Strategist, Informa Financial Intelligence.

[2] Informa Financial Intelligence.

[3] Informa Financial Intelligence.

[4] Tautvydas Marciulaitis, 12/7/17.