The criticality of forecast accuracy

“There are two kinds of forecasters. Those who don’t know and those who don’t know they don’t know,” John Kenneth Galbraith said decades ago.

The large peer group earning a Rodney Dangerfield forecasting award today of course includes Galbraith’s fellow economists. They are joined by meteorologists, product development teams, my stockbroker, election pollsters…and sales organizations.

The Blue Dots A4 precision AlignmentTM methodology stresses forecast accuracy for the same reasons that have been drummed into our heads as operating executives over many years: effective management of capital; protecting enterprise value by setting and meeting investor expectations; balancing people resources to deliver products, services, and customer success; and evaluating and directing sales teams.

Given the criticality of matching forecasts and performance, how successful are companies at accomplishing the task? After all this time, forecasting should be an accepted science now…right? Are the companies that have turned guesstimating into reliable and predictable science in the majority or are they the exception? And what happens to companies that experience a gap between forecasts and sales?

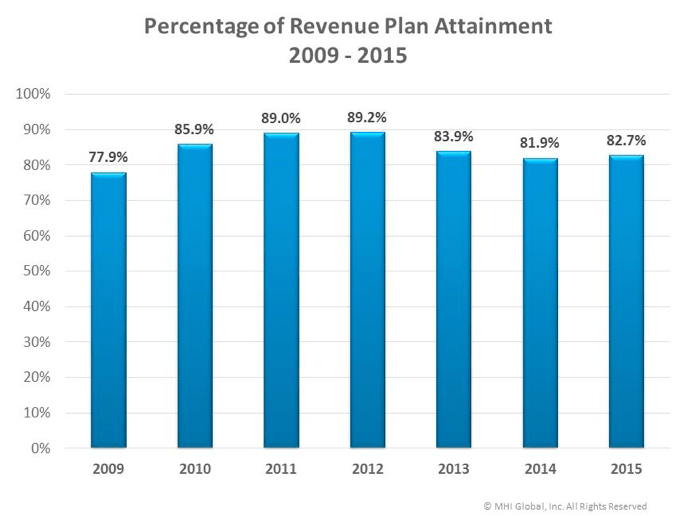

The chart below from Miller Heiman Group examines the percentage of planned revenue that was achieved in their survey of a broad array of companies. It shows that we have a long, long way to go to achieve widespread forecast accuracy. Revenue achievement gaps of 10% to 20% are the norm.

Other research found that as many as 79% of sales organizations miss their forecast by more than 10%.[i] Contributing to forecast failure is that 54% of deals forecast to close by sales reps never close.[ii] Of course a revenue “Plan” may not translate directly to a company’s communicated commitment to stakeholders but, regardless, the impact of missing targets significantly and frequently takes a toll on the team and the company.

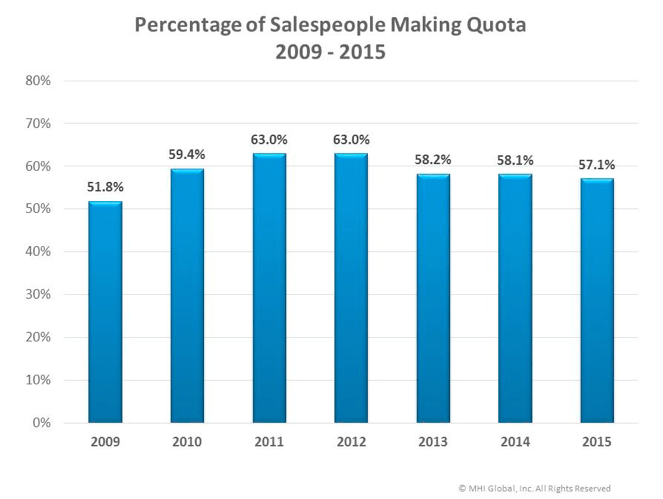

An examination of performance versus sales quotas provides another indicator of the accuracy problem. The chart below, also from Miller Heiman Group, illustrates that quotas, a foundational component of company-wide sales targeting, are routinely missed by 37% – 48% of sales reps.

Why do so many reps miss their quotas? Some of the explanation lies in the quality or skills of the people hired; the incentive systems that are designed to stretch sales people; and baked-in turnover expectations. However, in many cases, quotas are set with only a nod to reality and are not driven by the wealth of data now available to inform quota-setting.

A partial list of the impact on companies that miss forecast includes:

- An instant hit to the share price for public companies

- Shaky valuations and difficulty raising new financing for private entities

- Reduced availability and higher cost of credit

- P&L and balance sheet instability and low visibility

- Chaotic budget management

- Volatile manufacturing schedules

- Excessive inventory costs

- Complex resource allocation challenges

- Eroding board confidence in the executive team and the company

- Degrading customer loyalty due to concerns they may be riding the wrong horse

- Low morale in the sales team and the company

- A long, difficult climb back to credibility

Fortunately, unlike weather forecasts or economic predictions, we can do something about the accuracy of sales forecasts. It is a good bet that every company with which you have been associated…regardless of size…attempted to accurately forecast sales. One indicator is that, across industries, reps and managers spend on average 2.5 hours and 1.5 hours per week, respectively, on forecasting.[iii] It is also a reasonable bet that those teams often made their projections without adequate data, tools, incentives, or the all-around rigor of a disciplined process.

So, how do we close the alignment gap between the forecast “art” that typifies John Kenneth Galbraith’s world and the scientific process that yields predictive sales forecast accuracy?

Three steps provide the required framework and discipline:

First, ensure that you have the right fuel for the forecasting engine. Big Data, coupled with AI, creates tremendous opportunities to transform intuitive sales forecasting into true predictive analytics. The key is to collect and interrogate deep data across customers and their buying habits; historical forecast accuracy; competitor status and likely actions; and market trends.

Second, provide forecasters with the right tools to turn data into knowledge. Used effectively, today’s many CRM and SFA solutions not only enable a more reliable snapshot forecast, they also provide visibility into issues and gaps, empowering sales managers to adjust sales efforts nearly as fast as conditions change.

Third, drive a rigorous process relentlessly. A comprehensive approach includes careful attention to quotas, compensation, customer behavior, evaluation of lead gen and other marketing programs, and product plans. Then add detailed pipeline management, identification and mitigation of deals at risk, and pointed direction to sales individuals.

What are some of the key factors that go into a successful forecasting machine? Here are ten examples:

1. Lead from the top: CEOs, CFOs, Business Unit execs, and Sales leaders all must communicate and drive the forecast accuracy imperative across the organization

2. Set specific goals for short and long-term forecast accuracy

3. Make thoughtful decisions about the appropriate forecast process based on the maturity of the company and sales organization

4. Equip and train the Sales and Marketing organizations with CRM and SFA tools customized to the company’s needs

5. Staff the Sales team with strong business analysts and data scientists

6. Make forecasting accuracy highly visible with a concise set of dashboards that visually communicate the good, bad, and ugly of current results and trends

7. Align incentive compensation throughout the Sales organization to motivate high-quality data input and forecast accuracy

8. Use forecast analysis as a major input to setting annual team and individual sales targets

9. Create MBOs for team members in Finance, Marketing, Manufacturing, and any other function either relying on or contributing to forecasting

10. Assess the forecasting process multiple times annually, learn, recognize achievement, honestly expose weakness, and continuously improve

There is of course no shortage of vendors hawking their data, CRM, and SFA tools. The important thing is that Sales does have what it needs to align revenue targets and forecasts with reality to improve accuracy, avoid the pitfalls mentioned earlier, and power greater success for the company.

[i] InsideSales.com, October 21, 2016 from SiriusDecisions.

[ii] CSO Insights 2016 survey.

[iii] SiriusDecisions quoted by CFO Magazine, March 31, 2016.